Blank Page

.png)

INFLUENCE™ as a currency: hybrid course melding principles in economics, sociology, and psychology, The intense program examines core venture capital structures, brand development, and social priming through social media influencers and applies them to create a new fund model where INFLUENCE is the currency. The London Fund's proprietary Echo Chamber methodology and investment approach help students drive the creation of an investment memo and echo memo for two real investments.

The London fund are investing in and advising IP-rich high-growth companies that focus on B2C and emerging tech with a particular focus on transformative technologies. We advise companies with $1M to $100M in revenue on inorganic growth strategies, mergers and acquisitions, debt and equity financing, and IPOs.

By actively partnering with entrepreneurs, INFLUENCE by The London Fund combines several critical disciplines: brand strategy, marketing, product design, social marketing, financial structuring, IP strategy, and channel creation. This enables the effective launching of products and technology we can identify, extend and defend through our echo chamber methodology.

In addition, INFLUENCE by The London Fund investment vehicle can boost growth by providing from $2 mm to $100M in early-stage and growth capital.

Website

Location

UK

Socials

Interested in investing in any of the startups?

To request and view the startups pitch deck and communicate directly, join thier private group on the Wavia platform.

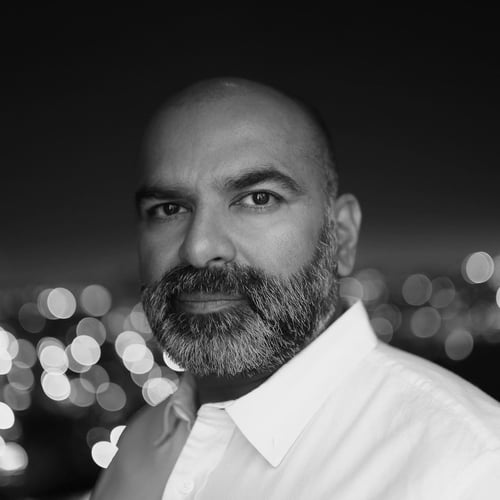

Founder

Ashesh Shah

CEO/Founder

Ashesh (Alex) is the creator of the Web3 platform INFLUENCE by The London Fund, Alex spent 30 years globally building, integrating, and leading technology-focused companies from concept to IPO across a range of sectors including loyalty, category management, data analytics, high-performance computing, payment processing, HR tech, CPG, AI, and fashion, holding every CxO title (except COO).

As a serial entrepreneur, he served on the founding team of nearly 20 companies, had 4 IPOs by 27, and over $2B in exits. As a fund manager, he directed over $1B AUM in several of his venture and PE funds across four continents with 97% IRR cash-on-cash returns. He holds a series of patents and served on the Advanced Research Board at Mass General Brigham (Harvard Medical), and the Presidential Task Force while at the CIA, holding top secret and special clearances. Most recently he was appointed Adjunct Professor at Williams College, teaching the multi-disciplinary course.